Port - Enter the port number to use for the email server.Server address - Enter the POP3 server address for the email account.

On the Configure email accounts page, select New, and enter the account details. Set up email accounts to import XML files and DANFE for NF-e Next, add the azure AAD application client ID, the client secret, and the tenant IDs as secrets to a key vault in azure and configure the same in Dynamics 365 Finance. The application you create will have the required mailbox permissions (POP) to read emails from the shared mailbox that you are using to receive emails sent by a vendor.

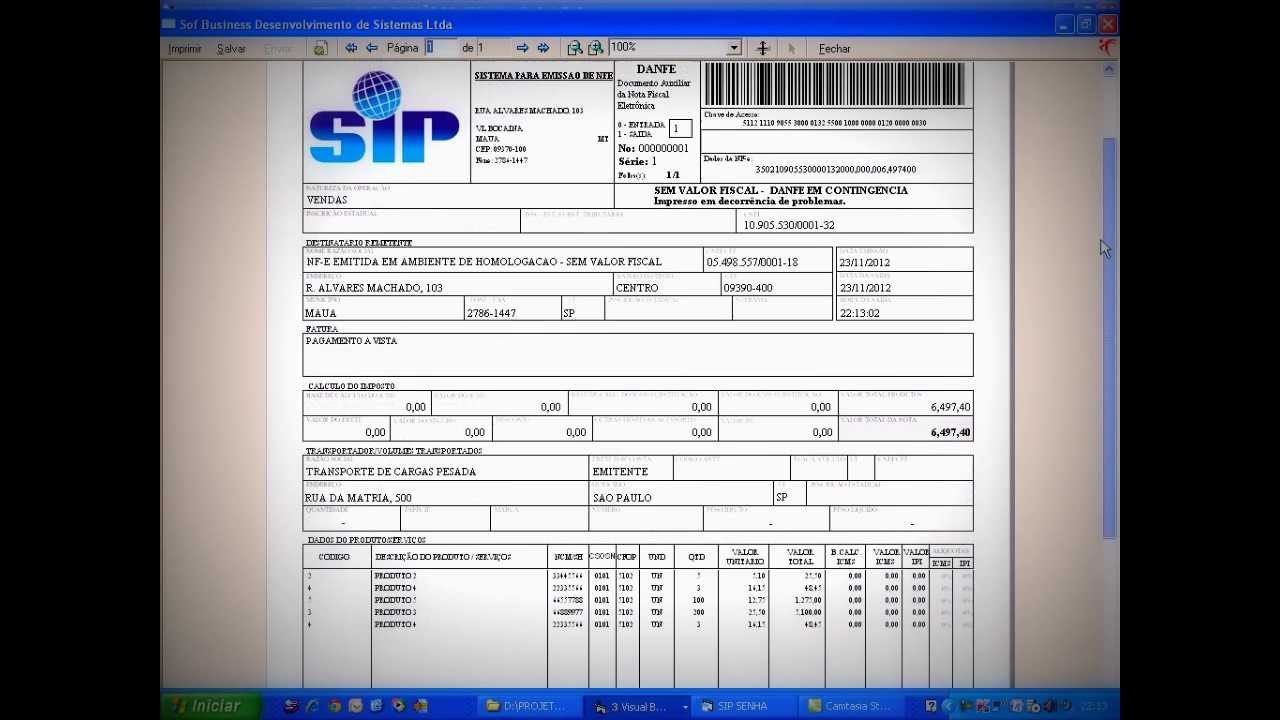

#NOTA FISCAL ELETRONICA REGISTRATION#

Remember that you must have the e-CNPJ A1 (Digital Certification), as other models are not accepted by the online system yet and your requirement will be denied if it is not the e-CNPJ A1format.Īfter getting the registration and the Sefaz authorization you only have to choose a company that will host the software of the NF-e.To use modern authentication to authenticate the connections to the POP3 server to read emails, complete the steps outlined here as a prerequisite to create an azure AAD application. To get the Sefaz authorization from your state you have to access the NF-e website and make your requirement. There are some companies as Certisign and Serasa providing the Digital Certificate, you only have to choose the one that fits you better. The NF-e has the legal validity guaranteed by the signature type through the Digital Certificate, that is the legal recognition of the online invoice. The first two documents required to the issuance of a nota fiscal are a Digital Certificate provided by companies linked to the government, and a Sefaz authorization from the state that your company belongs to. The NF-e is important to provide a better control about transactions by Secretaria da Fazenda or Sefaz -, which is the institution in charge of checking all the stages of the movement of goods, making use of the electronic files to make the surveillance process faster and safer. To view the entire list of benefits related to Nota Fiscal Eletrônica, click here.

0 kommentar(er)

0 kommentar(er)